Concerns arising from unstable potash markets

Times of conflict and war create chaos, uncertainty, and disruptions for markets. Markets hate uncertainty! One market that has been particularly affected by uncertainty is the potash market. Potash is a key component of fertilizer, which is an important input for producing crops all over the world. As a result, mining, exports, and timely delivery are vitally important as the northern hemisphere moves into planting season. The uncertainty resulting from Russia’s invasion of Ukraine has had a dramatic impact on potash prices in 2022, with the price of a tonne of potash rising from US$221 at the end of January to US$562 in mid-April, an increase of 154%.

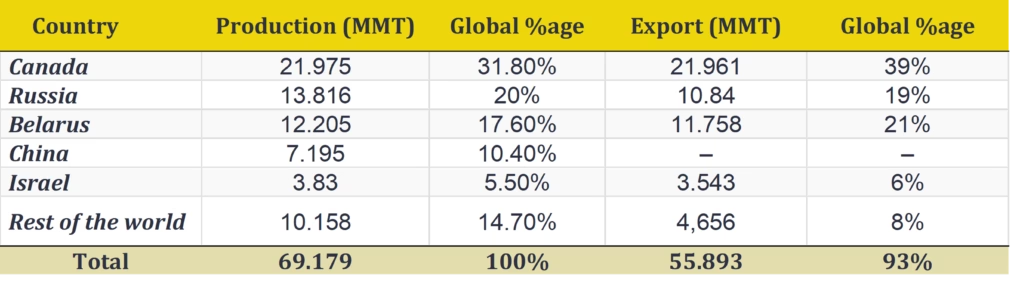

The current rise in the price of potash is greatly attributed to the halt in exports from Russia and Belarus. While Canada is the top potash exporter, Russia and Belarus are the second and third largest exporters and are facing sanctions and barriers on exports to many countries. Together, they attributed 40% of the 2020 imported supply of potash (Table 1). Russia’s actions have resulted in greater supply challenges for other potash producers and coupled with logistical challenges in getting potash to port for export, the market faces higher uncertainty and therefore higher prices.

Table 1: World Potash production and exports, 2020

Canada’s not the only potash producer

Canada possesses an ample potash supply, with numerous potash mines. However, Canada’s ability to increase production is very limited. Even if production were able to be ramped up in the short term, there is no ability for Canadian potash mines to make up for the 40% production share from Russia and Belarus. When two countries that account for such a significant share of the global production market have export sanctions levied against them, the economic effects of this extend far beyond the potash mining firms. In response to the sanctions, Russia and Belarus moved to suspend fertilizer exports. The potash export restrictions will potentially have negative implications for the countries that relied on these markets as their source for potash. China and India are the third and fourth largest potash importers and will source some of their needs from both Belarus and Russia. In 2020, China and India made up over 21% of all potash imports. India is capable of producing crops year-round and has increased their imports from Canada and Isreal to ensure they have sufficient supplies for their upcoming planting season. China is sufficient in the production of some fertilizer ingredients, relying on Russia for 30% of its potassium chloride imports. China produces large amounts of fruits and vegetables that require significantly less fertilizer than bulk commodity crops, which may lessen the negative impacts of a reduced potash supply.

Fertilizer for food

There is a potential food production crisis looming, driven by Russia’s war on Ukraine. Reductions in the supply of potash could have negative impacts on crop production in situations where insufficient fertilizer is available. When it comes to crop production, fertilizer is most often applied pre-seed to pre-plant emergence. There is some uncertainty as to how many importers received their fertilizer before seeding this year. A potential food production crisis looms in the uncertainty of what will happen in the coming growing seasons, as it all hinges on when the war ends, sanctions are lifted, and logistics resume to normal. Canada could increase its potash production, but the global effect of this would be minimal at this current moment, given that seeding has already begun in many regions of the world.

The butterfly effect of policy

This clearly illustrates how policy decisions in one area can have detrimental impacts on other policy areas. Export restrictions have been enacted to reduce the amount of foreign currency entering both Belarus and Russia, but these restrictions will have spill-over effects in other countries. For the transportation and trade of commodities and products to efficiently take place the entire system needs to be free of constraints or situations that can stress the system. The war in Ukraine is stressing the movement of potash to markets that require it as a crop input. Existing stocks may be able to address some of the demand needs, but if the war and the restrictions continue beyond the summer, the looming crisis for food production significantly worsens.