Canola trade between Mexico and Canada has a significant history and continues to be an important aspect of their bilateral trade relationship. Canola, a crop derived from rapeseed, is used primarily for its oil, which has various food and industrial applications. This blog discusses the historical and contemporary trade in canola between Canada and Mexico.

The Mechanics of International Trade

A fundamental aspect of trade between countries is that it raises living standards by providing consumers with a greater variety of goods from which they can choose. The World Trade Organization (WTO) regulates and facilitates international trade and, among other things, ensures that every country’s consumers are being supplied with food that is safe to eat. To guarantee food safety, the WTO relies on two instruments: the Technical Barriers to Trade Agreement, which ensures that countries don’t enact illegal trade barriers in an attempt to protect their own farmers from international competition; and the Agreement on the Application of Sanitary and Phytosanitary Measures (SPS), which sets out the basic rules on food safety and animal and plant health standards that governments are required to follow.

Article 2 of the SPS Measures states:

“…members shall ensure that any sanitary or phytosanitary measure is applied only to the extent necessary to protect human, animal or plant life or health, is based on scientific principles and is not maintained without sufficient scientific evidence …”.

Unfortunately for global consumers, global producers, and the environment, agricultural biotechnology products are still resisted by some governments who cite lack of scientific evidence about their safety [1]. The current Mexican administration is one of these governments.

The Decree of Discord

On Dec. 31, 2020, Mexico’s president issued a decree that would ban the import of GM corn beginning on Jan. 1st, 2024. This decree has no scientific justification as GM corn has been approved by dozens of government agencies around the world for production and import following robust risk assessments, all of which concluded there was no greater risk from GM corn than non-GM corn. Mexico appears to be retreating from a ban on GM corn imports from the US after the Mexican agricultural industry voiced concerns that it would significantly disrupt their operations and raise domestic food prices. A recent study shows that best case scenario, a GM corn import ban would cost the Mexican economy US$3 billion annually in the first five years, and raise the price of yellow corn by 81%. Nonetheless, the current Mexican administration is now actively trying to ban GM cotton which has been cultivated in the country without any controversy for 20 years, and accounts for over 90% of the cotton produced in Mexico.

Mexico’s sudden shift away from three decades of science-based regulations has left the Canadian government and Canadian producers wondering what might happen if Mexico’s current desire to reject science-based regulation and trade rules is extended to Canadian GM canola exports to Mexico.

Could Mexico ban Canadian canola imports? It could, but this move would be an illegal trade barrier as there is no evidence of risk from the consumption of GM canola. GM canola has been safely planted and consumed since 1997, with any environmental or human health harms. What would this mean for Mexico economically?

Canada-Mexico Canola Trade

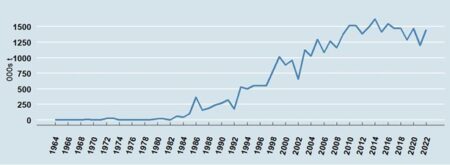

Canola was first commercialized in Canada in the early 1970s, offering a healthier oil for human consumption. Over time, Canada has become one of the world’s largest producers and exporters of canola, with Mexico being one of its key trading partners. The North American Free Trade Agreement (NAFTA), implemented in 1994, played a significant role in canola trade between these two countries. NAFTA eliminated tariffs and trade barriers among its member countries – Canada, Mexico, and the United States – thus, increasing trade in various goods including canola. Figure 1 illustrates total Mexican canola imports between 1964-2022;practically all of these imports come from Canada. Imports remained largely flat until the early 1980s and have steadily increased since then, benefiting both Canadian exporters and Mexican consumers.

|

| Figure 1. Total Mexican canola imports Source: Authors based on Index Mundi (2023). [2] Notes: Imports are in thousands of metric tonnes. |

Estimating the Impacts of a Potential Mexican Canola Import Ban

Canola trade between Mexico and Canada continues to be strong under the Canada-United States-Mexico Agreement (CUSMA), which replaced NAFTA as the governing trade agreement in North America in 2018. CUSMA maintained most of the tariff-free trade provisions of NAFTA, ensuring that canola trade between Mexico and Canada remained largely unaffected. However, should Mexico decide to ban GM canola imports, a significant welfare loss to the Mexican and Canadian economies can be expected.

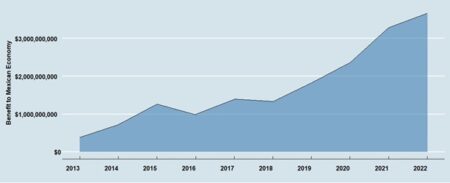

To show this, a supply and demand schedule for Mexican canola oil imports was created. The equilibrium price of C$1,129 per tonne, and the average yearly quantity of 18.6 million tonnes of imports was used to model the Mexican canola import market. The data helped estimate the consumer welfare (benefit) generated between 2013 and 2022 for the Mexican economy.

Using the model to look at the past, we find that over the last 10 years, the Mexican economy has cumulatively perceived $17.2 billion in benefits, with annual benefits in each of the past 2 years exceeding $3 billion. Importers use this oil for either food or industrial processes and are able to keep their prices low, from which Mexican consumers benefit. With a ban on GM canola imports, these benefits become zero.

|

| Figure 2. Mexican benefits from canola imports from Canada Note: a 5% net present value was applied to yearly calculations. Source: Data was obtained from the Canola Council of Canada. |

Of course, should Mexico decide to not import GM canola oil anymore, there are alternatives with their own health pros and cons. Corn and soybean oil are not listed below as, if Mexico banned GM canola oil, the ban would most likely extend to the import of GM corn or soy oil.

| Oil Type | Pros | Cons | Source(s) |

| Olive Oil | – Rich in monounsaturated fats – Contains antioxidants and anti-inflammatory properties | – Lower smoke point (not suitable for high-heat cooking) – More expensive | American Heart Association |

| Coconut Oil | – High smoke point (suitable for high-heat cooking) – Contains medium-chain triglycerides (MCTs) | – High in saturated fats (may increase LDL cholesterol levels) | American Heart Association: |

| Sunflower Oil | – High in polyunsaturated fats – High smoke point (suitable for high-heat cooking) | – May contain high levels of omega-6 fatty acids – Lower in monounsaturated fats compared to olive oil | American Heart Association |

| Avocado Oil | – High in monounsaturated fats | – More expensive | American Heart Association |

| – High smoke point (suitable for high-heat cooking) | Healthline | ||

| Grapeseed Oil | – High in polyunsaturated fats – High smoke point (suitable for high-heat cooking) | – May contain high levels of omega-6 fatty acids – Can be expensive | American Heart Association |

Beyond the health aspects of alternative vegetable oils, Mexico will have to guarantee an average 87,400 tons of oil to substitute the amount it currently imports from Canada. Which oil will replace canola oil in the event of a ban? Can they secure a source to guarantee the amount they consume every year?

Costs of Alternative Vegetable Oils

For a moment, lets assume palm oil is the alternative Mexico importers turn to should they reject canola oil. Palm oil production has significant negative environmental impacts, including deforestation, habitat loss, and greenhouse gas emissions. Conversely, the production of Canadian canola contributes to improved agricultural sustainability.

Conclusion

There doesn’t seem to be any logical reason as to why Mexico would want to ban GM canola imports, but there is also no logical reason for banning GM corn imports or working to prevent Mexican farmers from being able to grow GM cotton. An overall negative outlook on agricultural biotechnology and its use in any form in Mexico will diminish Mexican consumer welfare significantly. It could also entail significant environmental impacts for the rest of the world. The shift away from transparent, consistent, and scientific-based assessments of commodity trade will be detrimental to the Mexican economy in the short to medium term.

Unfortunately, we are also left to wonder: will Mexico ban GM canola imports?

References

- Fontanelli, F. (2021). Unspoken SPS-plus and SPS-minus aspirations: biotechnologies in EU and US trade agreements. European journal of risk regulation, 12(3), 564-583.

- Index mundi. 2023. Rapeseed Oilseed Imports by Country in 1000 MT. Available at: https://www.indexmundi.com/agriculture/?commodity=rapeseed-oilseed&graph=imports

- Drabik, D., De Gorter, H., & Timilsina, G. R. (2014). The effect of biodiesel policies on world biodiesel and oilseed prices. Energy Economics, 44, 80-88.

- Canola Council of Canada. 2023. Markets & Stats. Available at: https://www.canolacouncil.org/markets-stats/production/