Framing what is known against what is not

Society is challenged, and at times troubled, as it grapples with what is known and what it not. Determining between fact and fiction helps understand risk. For society, uncertainty is not new but its importance has increased in the modern day.

Thomas Kuhn was one of the first to discuss the tradeoff between what is known and what remains unknown. Kuhn, an American physicist, philosopher, and professor at both the University of California – Berkeley and Princeton University, is best known for his 1962 publication The Structure of Scientific Revolutions. This book is regarded as the first discussion on how society frames risk and the introduction of the paradigm shift.

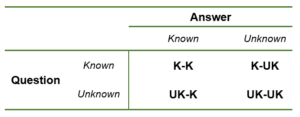

Essentially, Kuhn posed how knowledge should be framed against the unknown to help individuals, experts and society make risk decisions. This has been framed in Table 1, a question is either known or unknown, and the same goes for the answer. Known-known (K-K) represents a known theory (question) about an issue or topic and the known data or results of that theory. At times, we have known theories, but no data yet, resulting in a known-unknown (K-UK) risk framing. Less often, there will be an unknown theory with known data (UK-K). The unknown-unknown quadrant is where there is no theory and no data. This quadrant is the focus of the majority of risk-related research.

Why framing risk matters to consumers

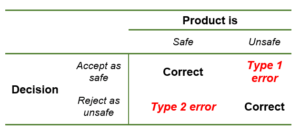

When new products are brought to the market, those involved in the supply chain from producers, consumers, and regulators apply the matrix of Table 1 to regulate and approve/reject the product, shown in Table 2. When a product is safe and regulators allow it on the market, then the risk decision-making system has worked correctly to deliver a safe product to the public for purchase. The opposite scenario is also a correct decision, where an unsafe product is rejected from entering the market.

While society is capable of making logically correct decisions in Table 2, society also struggles in two capacities. The first, Type 1 error occurs when an unsafe product is accepted as safe and is allowed to enter the market. Such an error creates a loss of trust in society over the safety of future products. A classic example of this was the 1960s morning sickness drug, Thalidomide, which resulted in birth deformities.

Type 2 errors are costly to society in a different way. When a safe product is rejected from entering the market or by society, there is a benefit loss. Genetically modified (GM) crops are a good example of this. Over one thousand studies have been conducted on the safety of the technology, however, not everyone in society is willing to accept this safe technology. Another example is the irradiation of meat, which kills any bacteria present in the meat, making it safer for us as consumers.

Knowledge is a crucial part of the risk decision-making process and decisions based on faulty knowledge can have very expensive costs. Society’s rejection of the use of irradiation results in thousands of people needlessly becoming sick from eating meat containing dangerous bacteria. Therefore for decision-makers to not understand risk is risky business for society.